EasyGST Download Software: Simplifying GST Filing for Businesses Introduction to EasyGST Software

EasyGST Download 2025 In today’s fast-paced business environment, compliance with tax regulations is a critical but often complex task. EasyGST crack Download The Goods and Services Tax (GST) has transformed the Indian tax system, requiring businesses to adapt quickly and efficiently. EasyGST Software is a user-friendly and efficient tool EasyGST 2025 Download for window designed to make GST filing simple, accurate, and stress-free for businesses of all sizes.

This software is tailored for accountants, tax professionals, and business owners who need a reliable solution for managing their GST returns without deep technical expertise.

Download EasyGST Download 2025

Other way Download Link

Why Choose EasyGST?

Hassle-Free GST Compliance

Easy GST free download eliminates the confusion and errors commonly associated with manual GST filing. With real-time data synchronization and intelligent error checks, it ensures your filings are always compliant with the latest GST rules and regulations.

Designed for All Business Types

Whether you’re a small trader Easy GST free Download for window pc x64 x86, a service provider, or a large enterprise, EasyGST scales to meet your needs. It supports multiple GSTINs, branches, and user roles, making it ideal for firms handling multiple clients or locations.

Key Features of EasyGST Software

1. Automated GST Return Filing

With EasyGST Price 2025, filing GST returns becomes a seamless process. It supports all types of returns, including:

- GSTR-1: Outward Supplies

- GSTR-2A & 2B Reconciliation

- GSTR-3B: Summary Returns

- GSTR-4 & GSTR-9: Annual and Composite Returns

You can upload data in bulk, auto-generate returns, and file directly through the software.

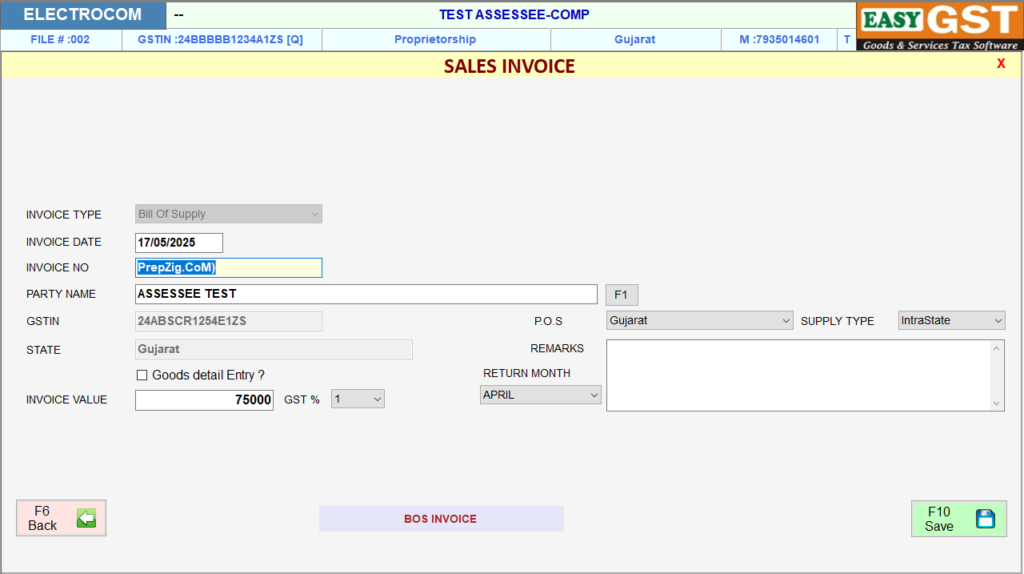

2. Invoice Management

Managing invoices is crucial for accurate tax calculations. EasyGST allows you to:

- Generate GST-compliant invoices

- Import sales and purchase invoices in bulk

- Match invoices automatically with GSTR-2A data

3. Advanced Reconciliation Tools

Reconciliation of purchase data with GSTR-2A and 2B is often tedious. EasyGST automates this process by:

- Highlighting mismatches

- Suggesting corrective actions

- Offering real-time matching of ITC (Input Tax Credit)

4. Cloud-Based Accessibility

Being cloud-based, EasyGST allows you to access your data from anywhere, anytime. This flexibility is especially useful for remote teams and multi-location businesses.

5. Robust Security and Data Backup

Security is a top priority. EasyGST offers:

- 256-bit data encryption

- Automatic data backup

- Role-based access control

Your tax data is always secure and recoverable.

Additional Tools and Integrations

Seamless Accounting Software Integration

EasyGST integrates easily with popular accounting platforms like:

- Tally

- Zoho Books

- Busy Accounting Software

- Excel (CSV formats)

This allows you to import financial data directly without manual entries, saving time and reducing errors.

Real-Time Notifications and Alerts

The software provides timely alerts for:

- Filing due dates

- Payment deadlines

- Errors in uploaded data

This ensures you never miss an important deadline again.

Benefits for Tax Professionals

Multi-Client Dashboard

Tax consultants and accountants can manage multiple clients with a single login. The dashboard offers:

- Client-wise segregation

- Quick access to filing status

- Document upload and sharing features

This streamlines your workflow and improves client servicing.

Audit and Report Generation

EasyGST provides audit trails and comprehensive reports, helping you prepare for:

- GST audits

- Financial reviews

- ITC claims and justifications

Conclusion

Make GST Filing Easy with EasyGST

EasyGST Software is more than just a filing tool—it’s a complete GST compliance solution. From return filing to invoice matching, reconciliation, and client management, it provides everything you need under one roof. Designed for simplicity and packed with powerful features, EasyGST helps you stay compliant, save time, and focus on growing your business.

Download EasyGST 2025

Other way Download Link